Excerpts from his presentation

Benefits of GST

For business and industry

- Easy compliance

A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent. - Uniformity of tax rates and structures

GST would make doing business in the country tax neutral, irrespective of the choice of place of doing business. - Removal of cascading

A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes. This would reduce hidden costs of doing business. - Improved competitiveness

Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry. - Gain to manufacturers and exporters

The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. This will increase the competitiveness of Indian goods and services in the international market and give boost to Indian exports. The uniformity in tax rates and procedures across the country will also go a long way in reducing the compliance cost.

For Central and State Governments

- Simple and easy to administer

Multiple indirect taxes at the Central and State levels are being replaced by GST. Backed with a robust end-to-end IT system, GST would be simpler and easier to administer than all other indirect taxes of the Centre and State levied so far. - Better controls on leakage

GST will result in better tax compliance due to a robust IT infrastructure. Due to the seamless transfer of input tax credit from one stage to another in the chain of value addition, there is an in-built mechanism in the design of GST that would incentivize tax compliance by traders. - Higher revenue efficiency

GST is expected to decrease the cost of collection of tax revenues of the Government, and will therefore, lead to higher revenue efficiency.

For the consumer

- Single and transparent tax proportionate to the value of goods and services

Due to multiple indirect taxes being levied by the Centre and State, with incomplete or no input tax credits available at progressive stages of value addition, the cost of most goods and services in the country today are laden with many hidden taxes. Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer. - Relief in overall tax burden

Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers.

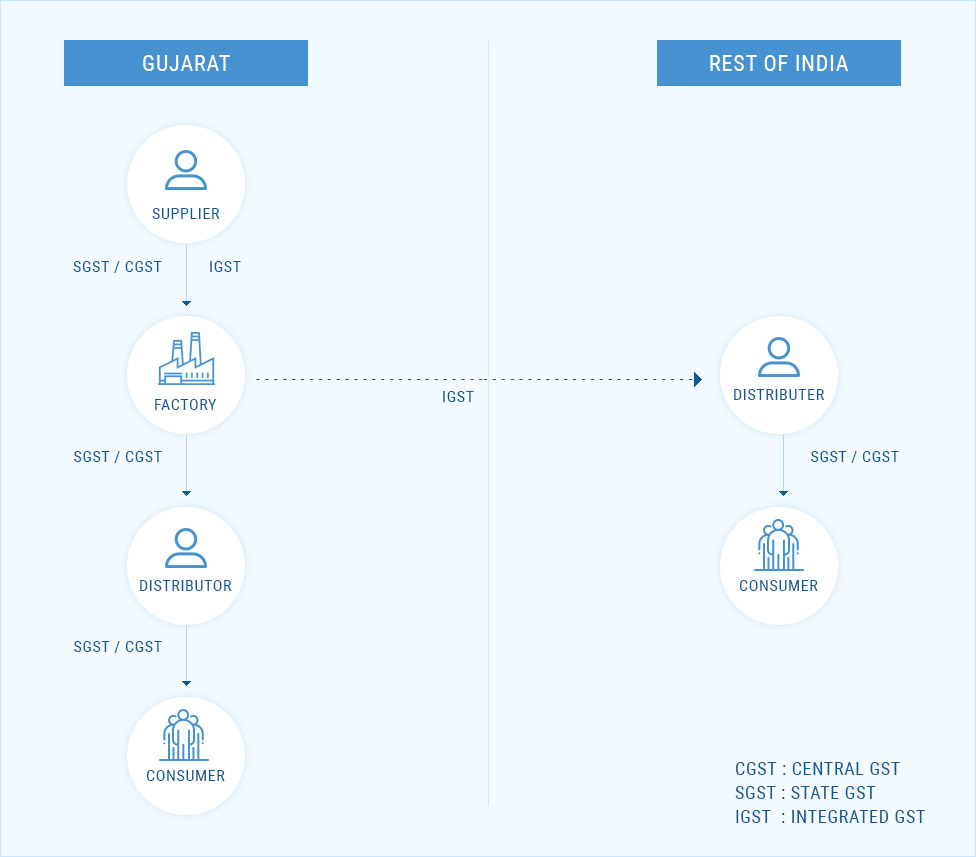

Due to federal structure India will have a dual model of GST. On all intra-state (i.e. within State) supply of goods/services Central GST (CGST) & State GST (SGST) shall be payable. On inter-state supply of goods/services Integrated GST (IGST) shall be payable. Diagrammatical representation is as follows

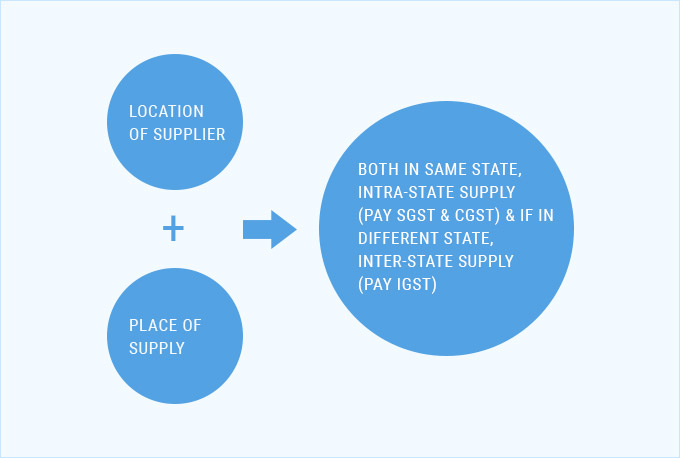

Determination of whether supply is intra-state or inter-state shall depend on the location of supplier and place of supply. Diagrammatically it is represented as under

Illustrative calculation of GST shall be as under

| PARTICULARS | INTRA-STATE SUPPLY | INTER-STATE SUPPLY |

|---|---|---|

| Value of goods/service | 100 | 100 |

| Levy of GST: | ||

| CGST @ 9% | 9 | - |

| SGST @ 9% | 9 | - |

| IGST @ 18% | - | 18 |

| Total | 118 | 118 |

Government had released Model IGST Law (provides principles for determining whether the supply is inter-state, intra-state or export/import & provides for levy of IGST); Model CGST/SGST Law (provides for levy of tax on intra-state supplies & administrative mechanism – due to duel model, CGST Law shall be passed by Central Government & SGST Law by every State Government) as well as Valuation Rules in June 2016. Revised draft of IGST Law & CGST/SGST Law was released in November, 2016. Entire discussion in this paper is based on revised laws.

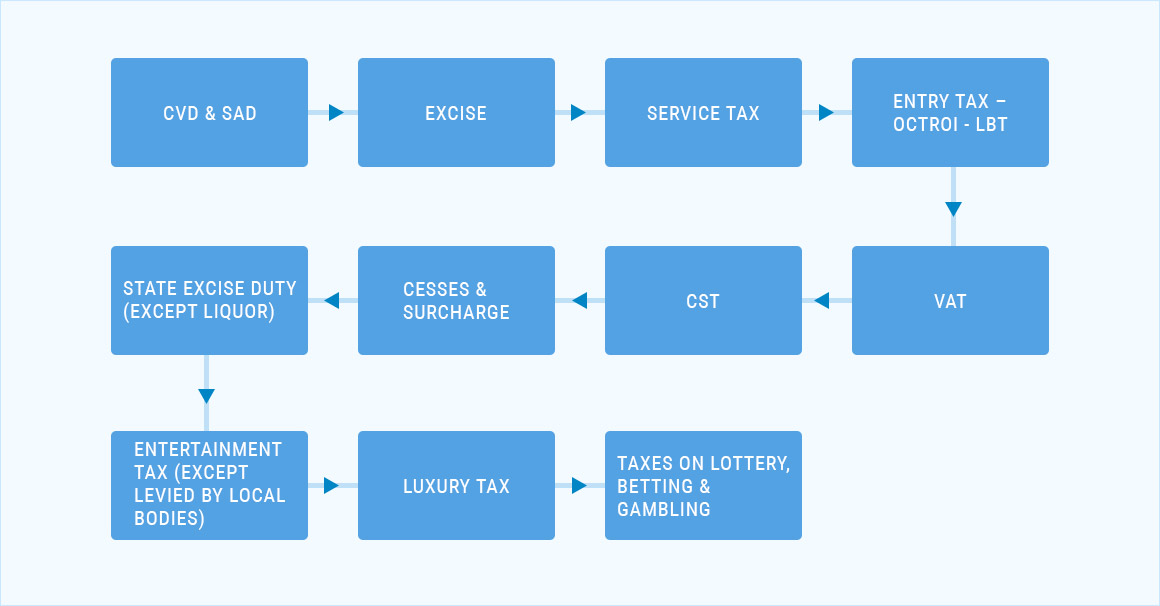

GST shall subsume following taxes

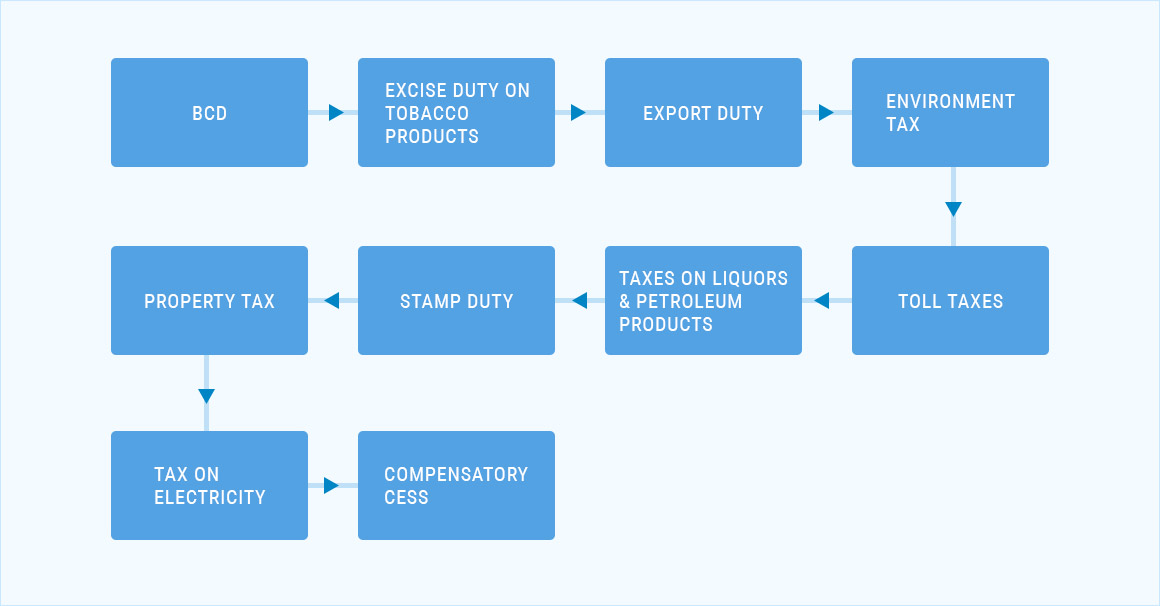

Following taxes shall however remain even under GST regime

Business Models in Tooling Industry & GST Impact

In this section we will analyze various business models prevalent in the tooling industry. For each business model we have highlighted the tax implication under the current regime and tax implication under the GST regime.

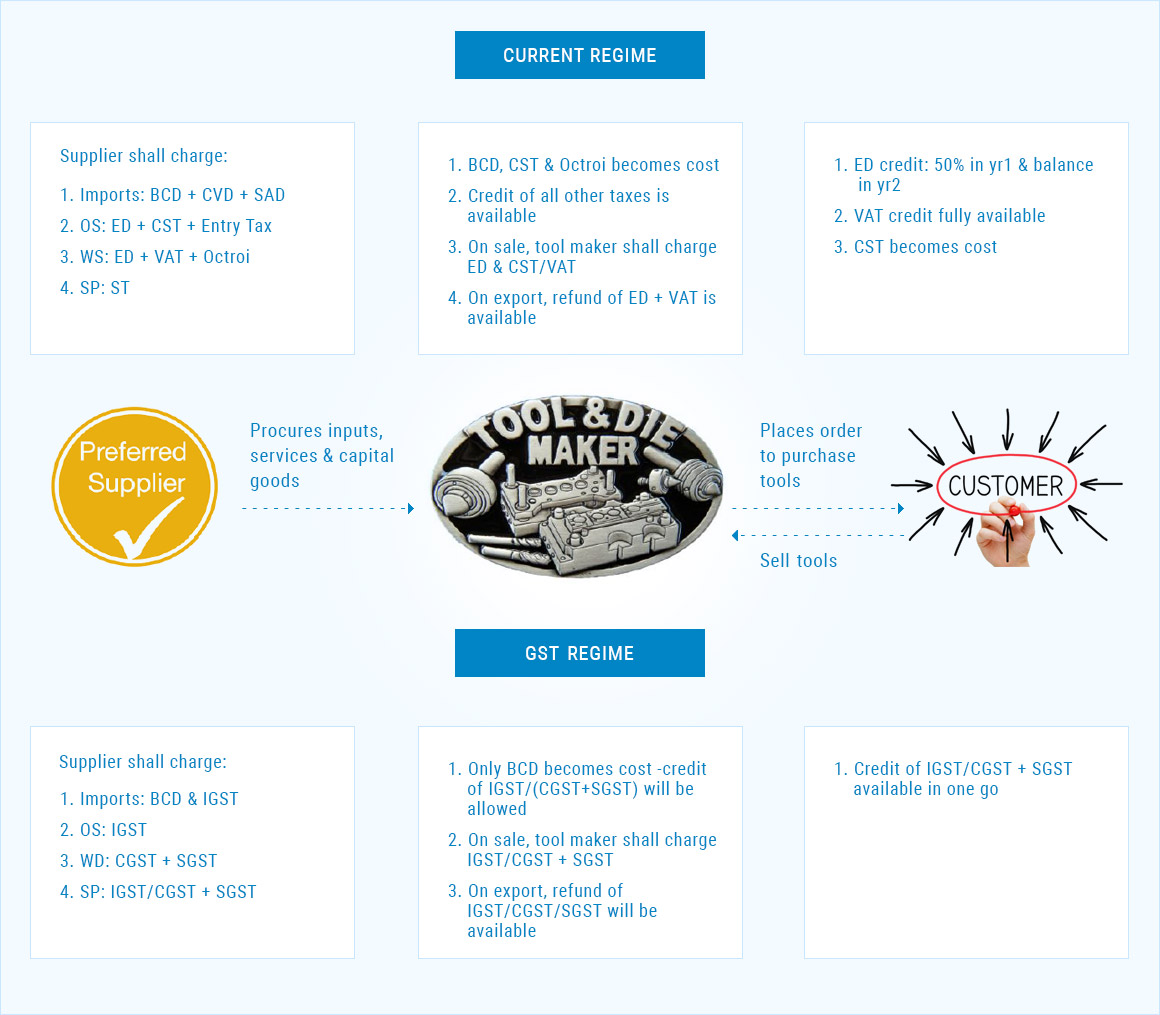

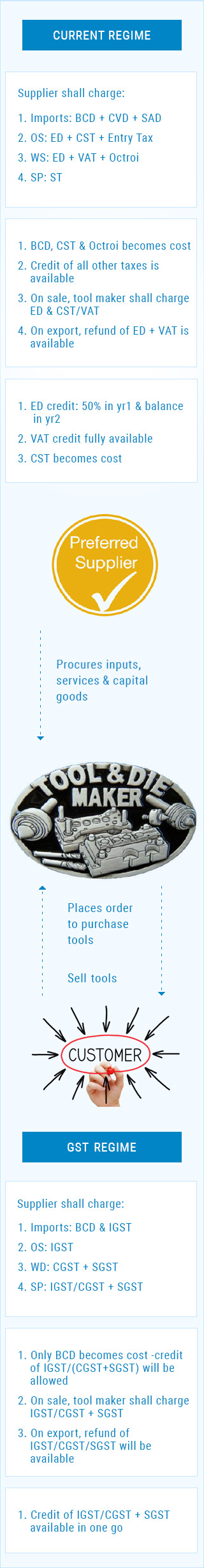

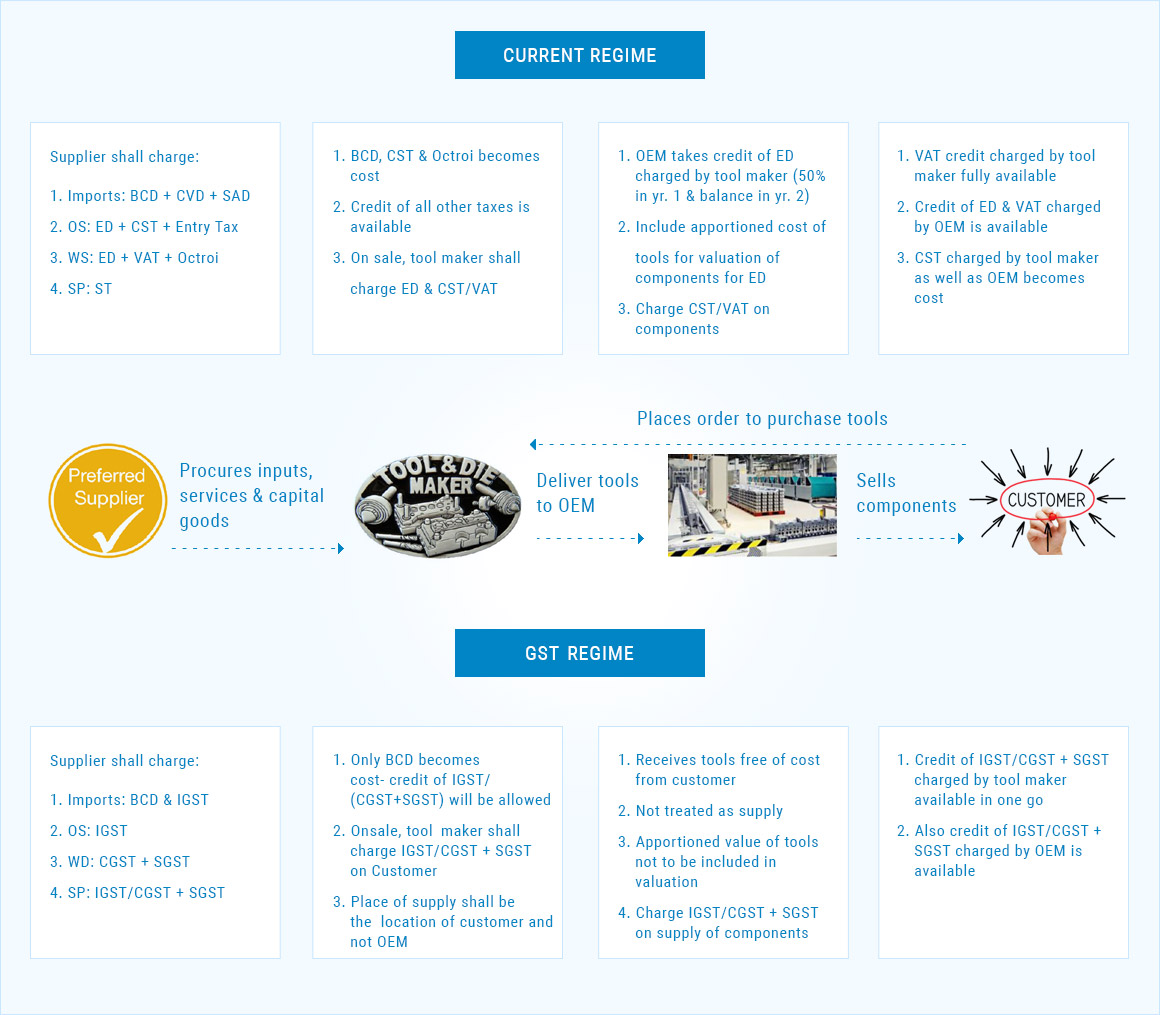

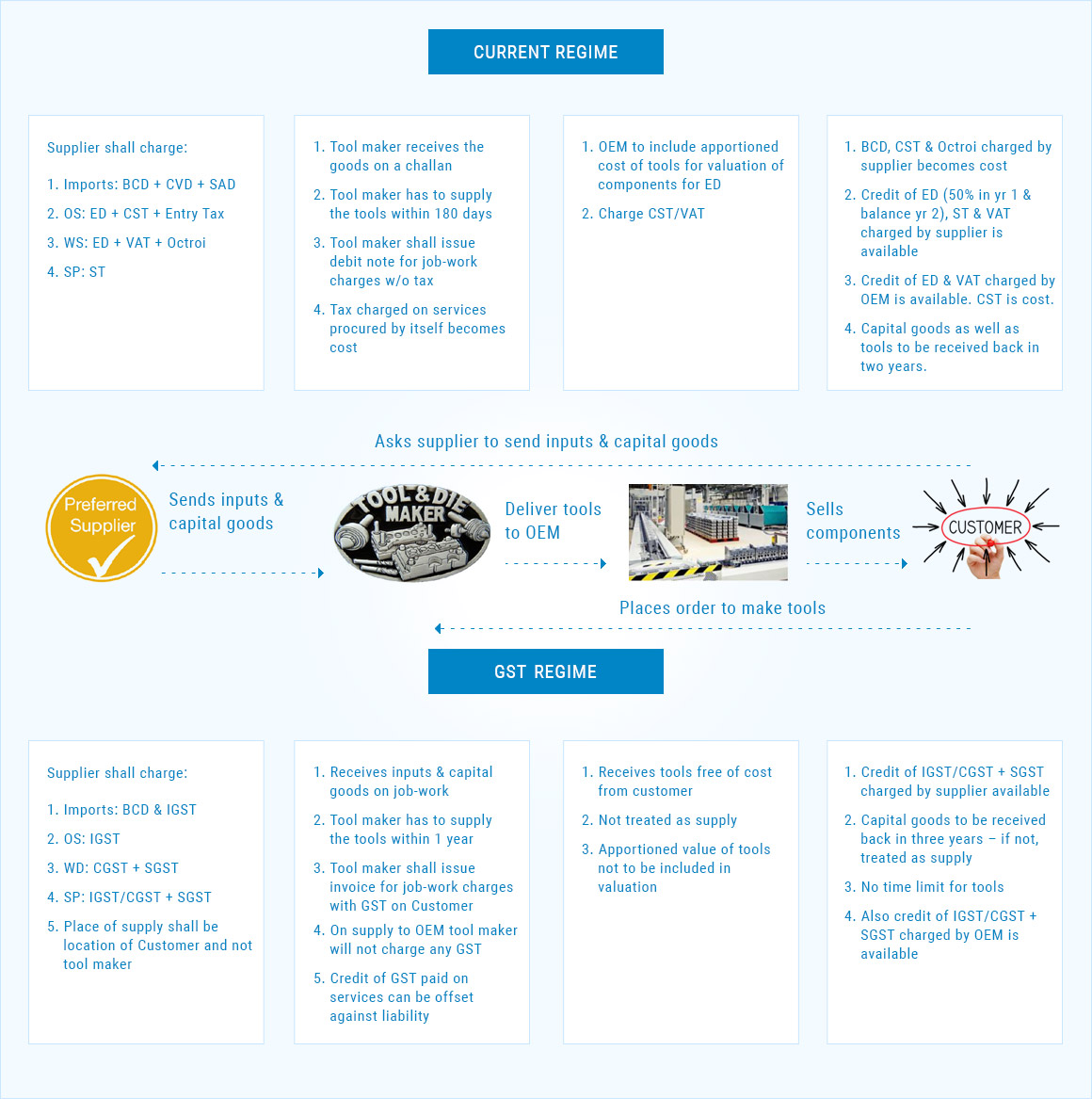

In the following diagrams acronyms stands as under :

| ACRONYM | STANDS FOR |

|---|---|

| BCD | Basic Customs Duty |

| CVD | Counter Veiling Duty |

| SAD | Special Additional Duty |

| OS | Outside State Supply |

| WS | Within State Supply |

| ED | Excise Duty |

| CST | Central Sales Tax |

| VAT | Value Added Tax |

| SP | Service Provider |

| ST | Service Tax |

| IGST | Integrated GST |

| CGST/SGST | Central/State GST |

Manufacture & Sale directly to Customer (Model – 1)

This is a vanilla model wherein customer will place an order to buy tools on the tool maker. Tool maker shall source all the inputs, capital goods and input services required to make the tools. After production, tool maker shall deliver the tools to the customer. Tool maker shall issue sale invoice. GST implications can be seen as under

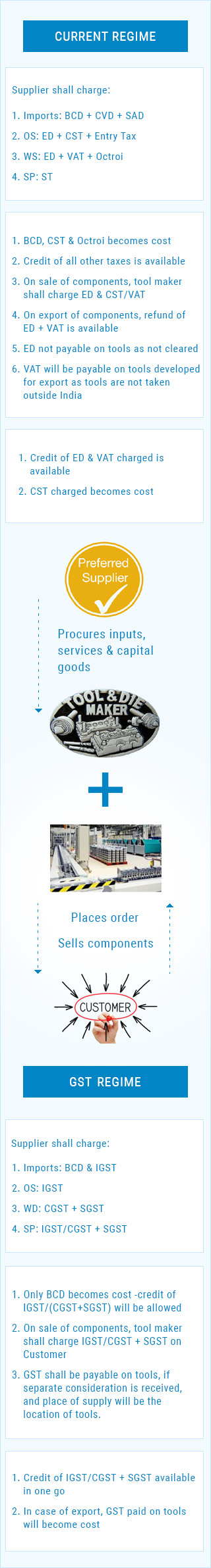

Manufacture and sale to customer but delivery to OEM (Model – 2)

Under this model, Customer places order on tool maker and instead of taking delivery of tools by itself asks the tool maker to supply the tools to Original Equipment Manufacturer (“OEM”). OEM will subsequently use the tools for manufacture of components which will be delivered to customer. Tool maker shall issue sale invoice on Customer for tools. Tax implications are as under

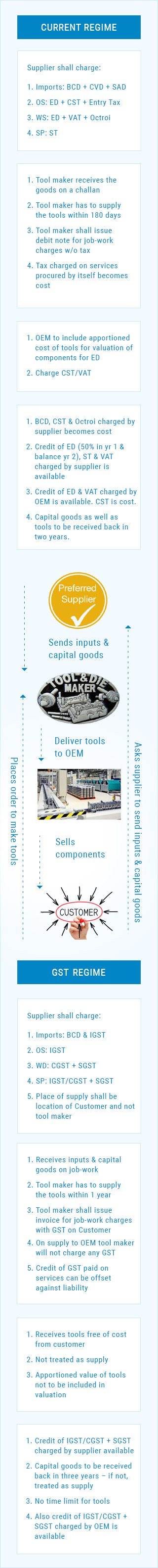

Job-work without payment of tax Model (Model – 3)

Under this model, customer will ask tool maker to manufacture tools on job-work basis. Customer will ask supplier to send the inputs and capital goods to tool maker. Tool maker shall send the manufactured tools to OEM for further use in manufacture of components. Tool maker will issue an invoice for job-work charges. Tax implications are as under

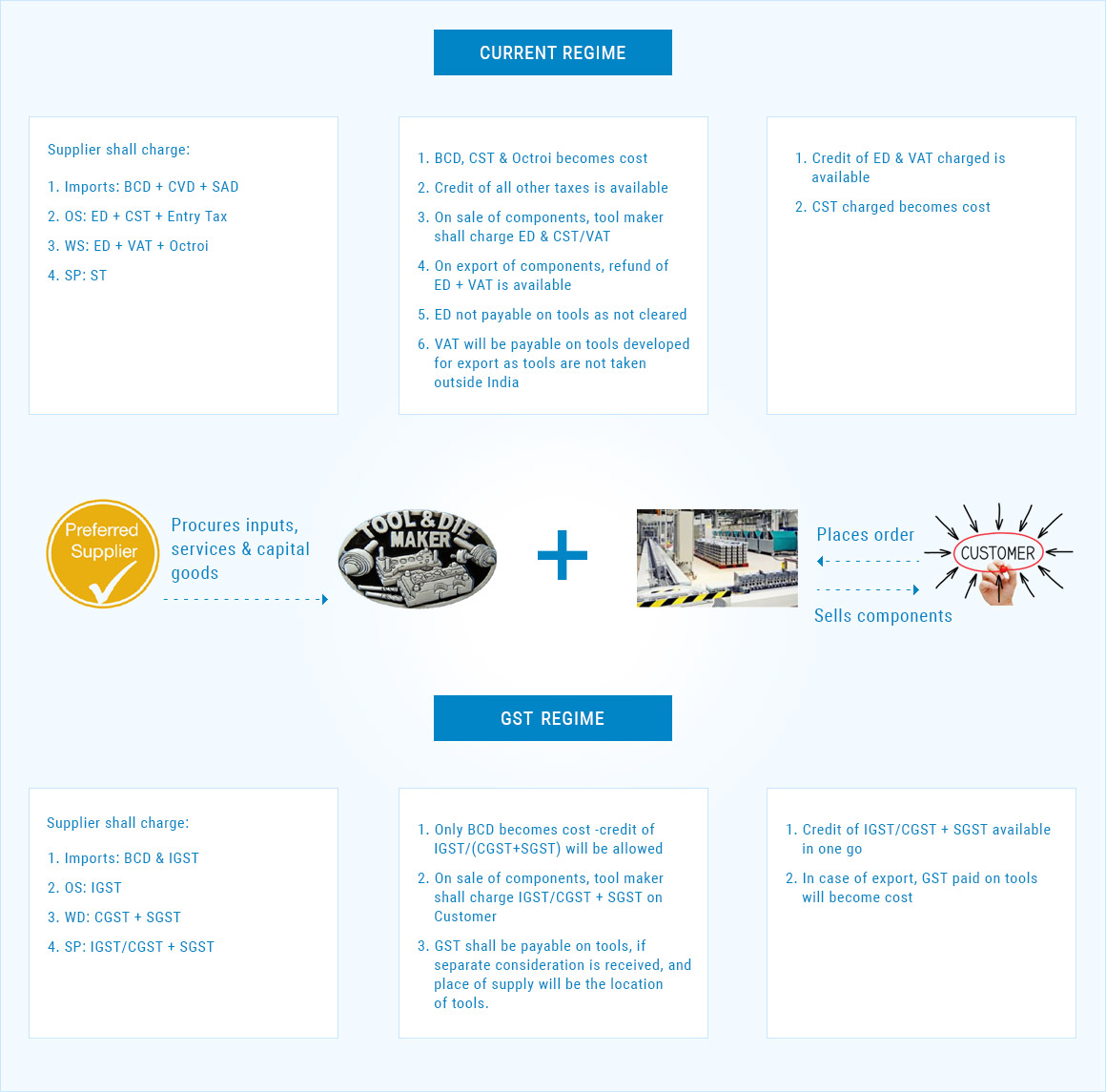

Tool maker as well as OEM supplier (Model – 4)

Under this model customer will place an order to buy components from the tool maker. Hence tool maker will not just manufacture tools but also use them in manufacture of components which will be supplied to customer. Tool maker shall charge the customer on sale of components. Tax implications are as under

Overall conclusion

From tax implications on all the above models, you must have noted that CST, Octroi & Service Tax which was becoming a cost in the current regime will no longer be the cost. Credit of GST paid to suppliers will be available for set-off and hence to that extent it shall improve the competitiveness of the industry.

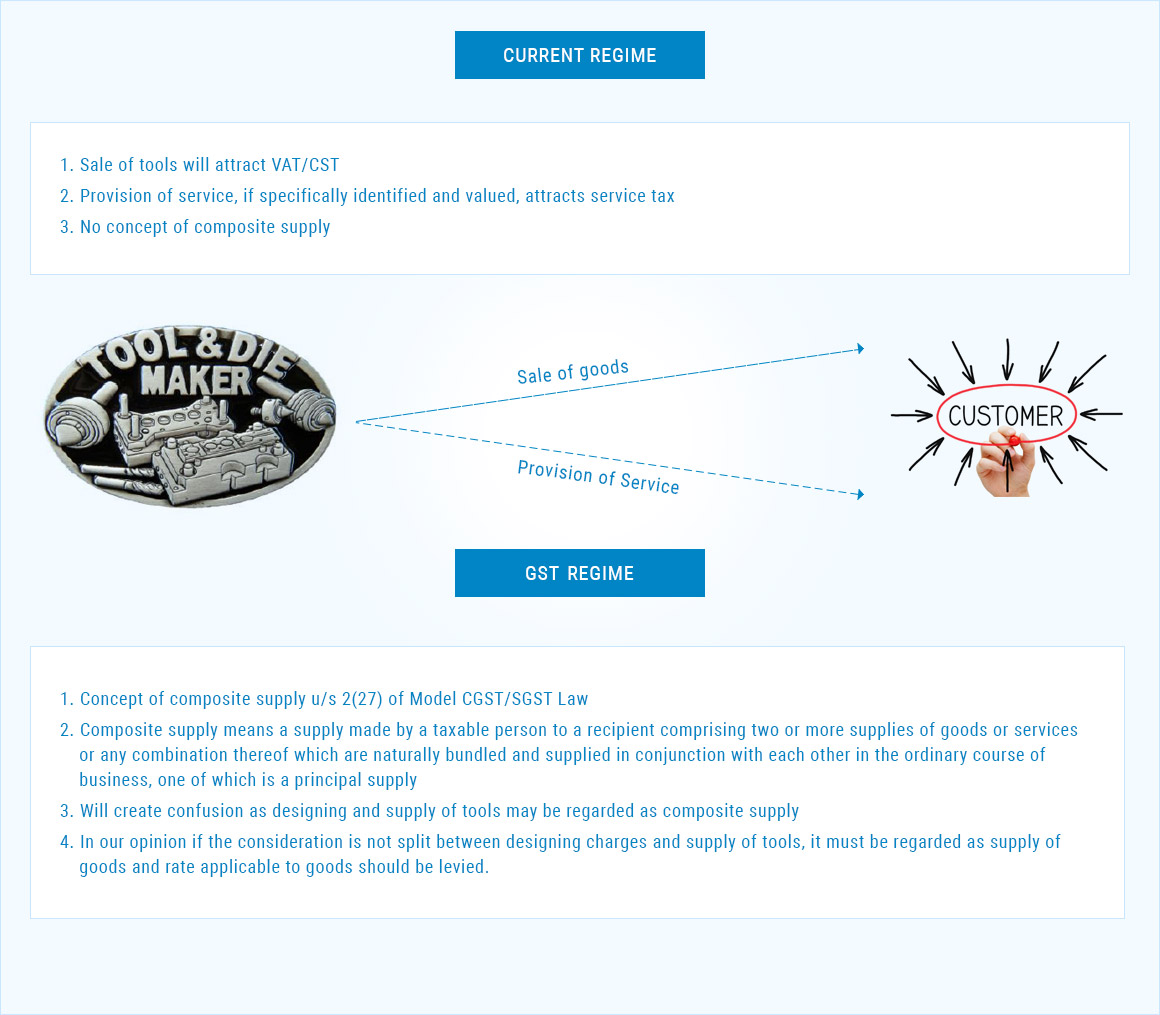

Different revenue stream

Tooling industry has two kinds of revenue streams. One is revenue from sale of tools and another is revenue from designing the tools (i.e. services). Tax implications are as under

By the Members, of the Members & for the Members

By the Members, of the Members & for the Members